Electrify Everything:

How will the Inflation Reduction Act impact your life?

For two years, we endured the long, winding, and incredibly bumpy road that led to passage of the Inflation Reduction Act (IRA). Now this historic federal legislation has the potential to improve our lives and the world around us by investing in clean energy, energy efficiency, and community development initiatives. But you might wonder…

How will the IRA actually impact YOUR life? Let us tell you!

We created a powerful presentation sharing everything you need to know.

Then we traveled around our region sharing this presentation with hundreds of people over the last year. Now, we’ve turned that presentation into an easy-to-view video format that you can watch whenever and wherever you want to learn more OR share information with others. Check it out!

Skip To A Section

Introduction

What is the Inflation Reduction Act (IRA) and what does it do?

The IRA is is $738 billion federal law aimed at curbing inflation by reducing the deficit, lowering prescription drug prices, adding a 15% corporate tax credit to generate revenue, and, of course, making MAJOR investments into clean energy and electrification programs.

Watch this overview to see where the clean energy money is going, and how it will help the U.S. reach its climate goals:

Electrification

How can the IRA help you #electrifyeverything in your home?

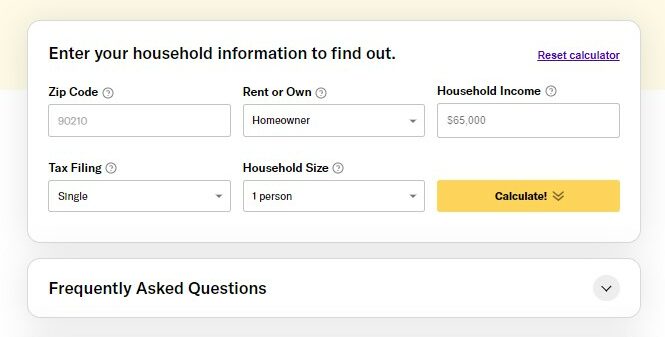

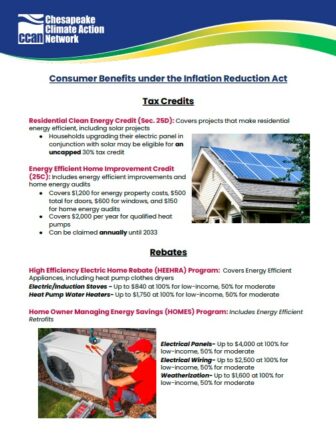

It uses two main mechanisms: tax credits and rebates, that you can use to get free money to help electrify. Tax credits can cover solar panels and electrical panel upgrades, and energy efficiency updates, while rebates can help you pay for energy efficient appliances, electric stoves, heat pumps, and more.

During the presentation, we discuss these opportunities and show you how to use Rewiring America’s IRA Calculator to figure out what credits and rebates are available to you. Take a look:

How much money can you get with the Inflation Reduction Act?

How Can You Benefit From The IRA?

Download the fact sheet to learn more about the tax credits and rebates available to you thanks to the Inflation Reduction Act!

Electric Vehicles

Learn how to utilize IRA Tax Credits to make the switch to an electric vehicle. It’s simple! You can get an EV tax credit up to $7,500, or up to $4,000 for used vehicles. And soon you’ll be able to get this credit at the point of sale. Learn more:

Buildings

The building sector accounted for about 33% of U.S. greenhouse gas emissions in 2019. The IRA will help reduce that number.

Learn more by watching this quick section of the video:

Energy Transition

Rural America will benefit from the IRA, with its specific focus on helping rural communities and former coal communities transition to clean energy. The IRA will invest 10 billion into financing for rural renewable energy investments, among other things, while creating thousands of jobs.

Here’s how!

Resilient Communities

How can your community use IRA dollars? The IRA includes business incentives for energy communities, that had historically been involved in fossil fuel production, low-income communities, tribal lands, and more. This will include climate justice grants–which are now opn for comment!

Learn more

Agriculture

20 billion dollars are being invested into agriculture conservation programs – learn more here!