For Immediate Release

September 10, 2014

Report Warns Investors: AVOID Dominion’s Cove Point LNG Export Project

Analysis details serious financial, governance and sustainability risks of controversial Dominion Midstream master limited partnership to export fracked gas

NEW YORK—A report released today warns investors of serious financial, corporate governance, and sustainability risks associated with Dominion Resources’ new gas export subsidiary, Dominion Midstream, which would own a controversial $3.8 billion liquefied natural gas export facility at Cove Point in southern Maryland. The report, prepared by the financial research firm Profundo, recommends that investors avoid buying units in Dominion Midstream (DM.). The company is currently awaiting approval from the U.S. Securities and Exchange Commission to make an initial public offering (IPO) on the New York Stock Exchange.

“Investors buying the common units of Dominion Midstream Partners (DM.) should realize that this company’s cash-flow is purely dependent on the Cove Point Liquefaction Project, for which further delays are expected,” said Jan Willem van Gelder, director of Profundo, the research firm that prepared the investor risk report. “In combination with the limited voting power of the unitholders and the dominant position of parent company Dominion Resources, investors are likely to face very uncertain returns.”

Key performance risks highlighted in the report include:

- Sustainability: The Cove Point project has already faced significant public protests and is likely to face mounting legal challenges because it threatens to cause significant air and water pollution, including impacts to the sensitive ecology of the Chesapeake Bay, to trigger more climate pollution than all seven of Maryland’s existing coal-fired power plants combined, and to drive the expansion of environmentally damaging fracking.

- Market volatility: The volatile and unpredictable prices of natural gas overseas could make export projects from the United States unprofitable, thus rendering Dominion’s Cove Point facility a stranded asset.

- Financial: Dominion Midstream’s undiversified cash flow and sole reliance on two customers increases the risks to investors from likely legal challenges or other delays, which could cause cost overruns or lead to missed contract deadlines for exporting gas overseas.

- Governance: Dominion Midstream unitholders would be last in line to receive cash distributions from the project. Meanwhile, no agreement requires parent company Dominion Resources to pursue a business strategy favoring Dominion Midstream, and the underwriters of the IPO are also investors in the parent company—constituting clear conflicts of interest.

“Dominion Midstream is concentrating significant financial risk on the success of Cove Point. The project faces continued delays in a business environment in which carbon pollution regulations are becoming stricter and the feasibility of the tax-free, master limited partnership structure is uncertain,” said Matt Patsky, CEO of Trillium Asset Management. “Long-term, I believe that investment in renewable energy infrastructure is a much smarter decision.”

Dominion Midstream filed an application with the Securities and Exchange Commission (SEC) in March 2014 to proceed with an IPO estimated to be worth approximately $400 million. In May, a Dominion shareholder and the Chesapeake Climate Action Network filed an official complaint with the SEC over Dominion’s failure to adequately disclose significant risks associated with the project.

“The Cove Point facility is already behind its original schedule. Even if Dominion receives the regulatory approvals it needs to begin construction, public interest groups are preparing for significant legal challenges that could cause further delay,” said Diana Dascalu-Joffe, senior general counsel at the Chesapeake Climate Action Network. “The project depends on an environmentally toxic and economically volatile fracking bubble, is vulnerable to the same climate change impacts it would worsen, and could be subject to increasingly costly regulations because of its large pollution footprint. This report warns investors of the full array of financial and reputational risks that come with Dominion’s massive fossil fuel bet.”

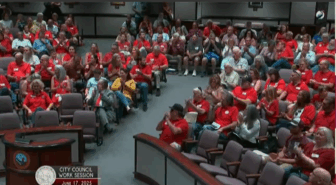

The $3.8 billion Cove Point gas export terminal, proposed on the Chesapeake Bay in southern Maryland, continues to face steep public opposition and protests because of its potential role in speeding hydraulic fracturing, or “fracking.” The proposal would also create global warming pollution on par with coal, and expose hundreds of nearby residents to potential explosion, flammable vapor cloud, and other liquefied gas catastrophes. Dominion is awaiting permit approval from the Federal Energy Regulatory Commission, which received an unprecedented number of public comments—more than 150,000—gathered by dozens of community, state and national groups that oppose the project.

The Profundo risk report was commissioned by the Chesapeake Climate Action Network.

The full report is available at: http://chesapeakeclimate.org/wp-content/uploads/2014/09/Dominion-Midstream-IPO-Risk-Report-9-10-2014.pdf

Contact:

Kelly Trout, 240-396-2022, kelly@chesapeakeclimate.org

Diana Dascalu-Joffe, 240-396-1984, diana@chesapeakeclimate.org

###

The Chesapeake Climate Action Network is the first grassroots, nonprofit organization dedicated exclusively to fighting global warming in Maryland, Virginia, and Washington, D.C. Our mission is to build and mobilize a powerful grassroots movement to call for state, national and international policies that will put us on a path to climate stability. Learn more at www.chesapeakeclimate.org.